"Stress test' to be applied to ensure home owners can truly afford home purchase at a certain level

Only time will tell about any effect on local real estate sales

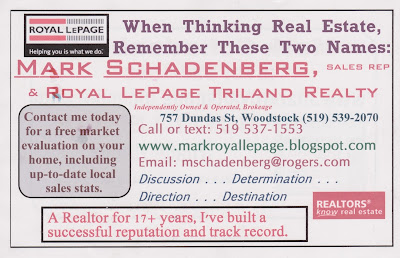

By Mark Schadenberg

The

new tighter rules in mortgages – as introduced by national Finance Minister

Bill Morneau -- could also set a trend as the banks and other lending

institutions will be forced to calculate an amount a buyer may be able to carry

on a monthly mortgage payment (PIT = principle, interest and taxes) based on

the 5-year fixed rate (Currently 4.64%) and not the advertised rate of the possibility of actually obtaining a lower

variable interest rate.

The so-called ‘stress test’ of a mortgage has been

created by Ottawa, in my opinion, to assist lenders in the process of

calculating risk if interest rates were to increase and a home owner was

enjoying a minuscule variable interest rate, which would rise along with posted

interest rates. If a home owner could no longer afford the home, then what?

I always remind anyone that qualifying for a mortgage has many factors beyond being comfortable with the principle, interest and taxes (PIT) each month. Additional factors include the buyer's credit record (beacon score), total annual income, employment security, commitment to other monthly amounts (Car lease, credit cards, furniture purchases, student loans) and overall future plans such as vacations and children.

With

the high ratio mortgage market always in place as a vast majority of buyers do

not have 20% down when buying, the federal government will likely soon increase

the CMHC mortgage insurance percentages again.

Not

to get off topic from the WIDREB (Woodstock-Ingersoll district real estate board) announced sales stats, (see post from Oct. 7), but there are many --

countless actually – factors dictating the market, ranging from availability of

rental apartments for our ‘aging in place’ demographic to employment

availability, interest rates, and even gas prices play their role in affordability of

commuting long distances from affordable homes to your employment.

^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^ ^

From

Dominion Lending Centres in a press release:

Measures

Affecting All Homebuyers

The Finance Department says in its press release that, "Protecting the long-term financial security of Canadians is a cornerstone of the Government of Canada’s efforts to help the middle class and those working hard to join it." This is a "Nanny State" measure to protect people from themselves, as the Bank of Canada has long been concerned about the growing number of households with excessive debt-to-income ratios. It will make housing less attainable, at least in the short run. If it, therefore, substantially reduces housing demand, home prices could decline, ultimately improving affordability. This, of course, is not what the 70% of Canadian households that already own a home would like to see.

The Finance Department says in its press release that, "Protecting the long-term financial security of Canadians is a cornerstone of the Government of Canada’s efforts to help the middle class and those working hard to join it." This is a "Nanny State" measure to protect people from themselves, as the Bank of Canada has long been concerned about the growing number of households with excessive debt-to-income ratios. It will make housing less attainable, at least in the short run. If it, therefore, substantially reduces housing demand, home prices could decline, ultimately improving affordability. This, of course, is not what the 70% of Canadian households that already own a home would like to see.

- Broadened

Mortgage Rate Stress Tests: To help ensure new homeowners can

afford their mortgages even when interest rates begin to rise, mortgage

insurance rules require in some cases that lenders “stress test” a

borrower’s ability to make their mortgage payments at a higher interest

rate. Currently, this requirement only applies to a subset of insured

mortgages with variable interest rates (or fixed interest rates with terms

less than five years). Effective October 17, 2016, this requirement will

apply to all insured mortgages, including fixed-rate mortgages

with terms of five years and more.

- A buyer with

less than 20% down will have to qualify at an interest rate the

greater of their contract mortgage rate or the Bank of Canada’s

conventional five-year fixed posted rate. The Bank of Canada’s posted

rate is typically higher than the contract mortgage rate most buyers

actually pay. As of September 28, 2016, the Bank of Canada posted rate was

4.64%, compared to roughly 2% or so on variable rate mortgages.

For borrowers to qualify for mortgage

insurance, their debt-servicing ratios must be no higher than the maximum

allowable levels when calculated using the greater of the contract rate and the

Bank of Canada posted rate. Lenders and mortgage insurers assess two key

debt-servicing ratios to determine if a homebuyer qualifies for an

insured mortgage:

- Gross Debt

Service (GDS) ratio—the carrying costs of the home, including the mortgage

payment and taxes and heating costs, relative to the homebuyer’s income;

- Total Debt

Service (TDS) ratio—the carrying costs of the home and all other debt

payments relative to the homebuyer’s income.

To qualify for mortgage insurance, a

homebuyer must have a GDS ratio no greater than 39% and a TDS ratio no

greater than 44%. Qualifying for a mortgage by applying the typically higher

Bank of Canada posted rate when calculating a borrower’s GDS and TDS ratios

serves as a “stress test” for homebuyers, providing new homebuyers a buffer to

be able to continue servicing their debts even in a higher interest rate

environment, or if faced with a reduction in household income.

The announced measure will apply to new

mortgage insurance applications received on October 17, 2016 or later.

Dr Sherry Cooper, chief economist with

Dominion Lending Services

LINKS:

Links here to stories from Toronto Star, Toronto Sun and Globe And Mail

RELATED LINKS:

No comments:

Post a Comment