Insurance in case of illness or injury for a home owner

By Mark Schadenberg

I don't sell insurance,

but at the end of the day, insurance is also about financial

planning.

What happens if you have a

disability (illness or injury) that doesn't permit you to work for a

few weeks?

Who then pays your mortgage?

No one expects to be

unable to work, but among the first to realize this possibility is

your lending institution as they want a backup plan for their clients

in case a hardship does occur. Your bank will sell you (could sell you) coverage to

assist in making mortgage payments if need be.

Again, I'm a full-time

Realtor and not a financial planner, lawyer, accountant or plumber.

At the same time, good solid advice is just that – a suggestion on

one place you can go to seek advice.

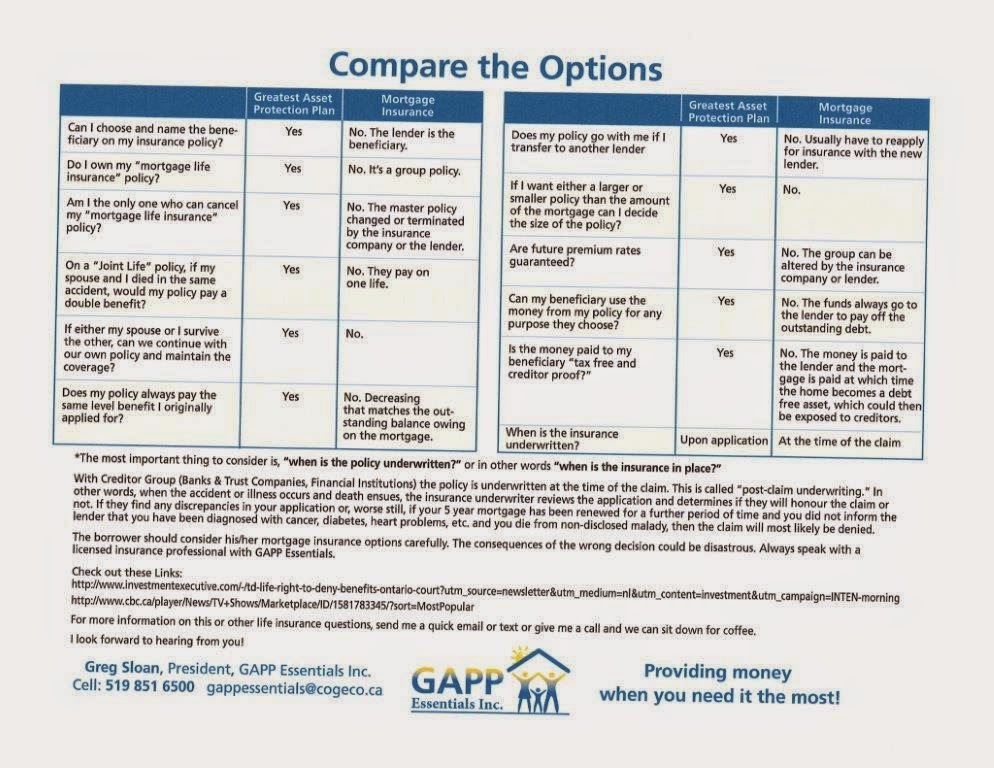

GAPP – Greatest Asset

Protection Plan – is someone you should contact. Greg Sloan (519)

851-6500 will show you all the pros and cons of various insurance

plans and explain how your greatest asset isn't your house. Your

greatest asset is you and your partner – the wage earners who

day-in and day-out are creating the life you and your family enjoy.

The story below was

printed this past weekend in The Toronto Star (I've used a lot of

links from this paper lately) and describes the scenario of a single

woman with terrific income who can't decide if she should buy a house

or continue to rent. It can be a dilemma, but buying is always the

best advice because after 20 years (more or less) of patience and

payments you own a significant investment.

Factors, including the

cost of maintenance or selling if you are relocating for work always

weigh in, but the goal of most Canadian is to be a home owner.

Check out the link and the attachments

from Greg Sloan. By the way, he is the same Greg Sloan who does

play-by-play on Rogers TV for London Knights games. Just like me, he

dabbles a bit in sports broadcasting as a hobby.

There is another story pertaining to the rise of home insurance due to floods and extreme weather.

There is another story pertaining to the rise of home insurance due to floods and extreme weather.

TORONTO STAR Link:

http://www.thestar.com/business/personal_finance/2014/06/02/shes_40_on_her_own_and_wants_to_buy_a_house_can_she_really_afford_it.html

http://www.thestar.com/business/personal_finance/investing/2014/07/07/homeowners_get_ugly_surprise_on_insurance.html

I was having difficulty with the correct link to this mortgage insurance story, so I broke my own rule and shall cut and paste here:

Vivian Elliot lost her husband in 1990. He died from a massive heart attack at age 51.

Six months later, she found out her mortgage life insurance wasn’t in force. The bank said the application was answered incorrectly.

“My husband brought the form home and we filled it out. As far as we knew, it was accepted,” she said.

“It was refused because my husband had ticked off a box saying he did not have lung disease. My husband had bronchitis and the insurance company stated this was lung disease.”

I was having difficulty with the correct link to this mortgage insurance story, so I broke my own rule and shall cut and paste here:

Mortgage insurance policies may not cover claims: Roseman

When insuring a mortgage, you expect a payout if you die suddenly. But banks can turn down claims years later because of incorrect answers to health questions.

Vivian Elliot lost her husband in 1990. He died from a massive heart attack at age 51.

Six months later, she found out her mortgage life insurance wasn’t in force. The bank said the application was answered incorrectly.

“My husband brought the form home and we filled it out. As far as we knew, it was accepted,” she said.

“It was refused because my husband had ticked off a box saying he did not have lung disease. My husband had bronchitis and the insurance company stated this was lung disease.”

Fortunately, she sued and won a settlement. Her lawyer said the bank was planning to train staff to go over forms with clients and avoid confusion.

Elliot contacted me because she was surprised to read my column about another widow, Angela Massa, who was turned down when claiming for life insurance on a $289,000 mortgage.

Scotiabank said her husband had answered a health question incorrectly and refunded the premiums paid (less than $5,000). It also charged her $12,000 to break the mortgage before its five-year term.

Massa sold the house, which she could no longer afford, and bought a smaller house with her son. She refused to transfer her Scotiabank mortgage, even though she could avoid paying a penalty by doing so.

I heard from several widows, who felt poorly treated by their banks when the mortgage life insurance they counted on failed to materialize. I also heard from a disgruntled banker, now retired.

“I have no qualms about exposing banks for their greed and arrogance,” he said. “Banks knowingly sell insurance to people, aware that many misrepresent the facts concerning their health.

“They collect premiums falsely and when required to pay, they escape payment by proving the falsity. In this scenario, it’s not in the banks’ interests to do due diligence up front on insurance questionnaires.”

Jim Bullock, an insurance broker and expert witness in lawsuits, says mistakes are inevitable when filling out complex questionnaires. People forget about health issues that result in a doctor’s visit, but turn out to be false alarms.

“It takes a trained insurance agent to explain the questions properly,” Bullock told provincial insurance regulators, who were looking into tightening the rules in 2008 (and dropped the idea).

“The agent has to explain that medication includes over-the-counter potions, herbals and food supplements. He has to decide if doctor includes a dentist or chiropractor. He has to delve into a question about symptoms, because this includes things as routine as headaches.”

CBC Marketplace did a 2008 show, In Denial, showing how mortgage life insurance can leave people in the lurch. Marketplace made up an insurance form, similar to what banks use, and asked consumers to complete it without an agent’s help. What happened? Three quarters of consumers with something to disclose about their health failed to do so.

Organizations selling insurance this way have a profound conflict of interest, says Bullock (who appeared on the show). They collect premiums for years on policies that would have never been issued if they had been properly underwritten. And they keep the money on the 90 per cent of mortgage life policies that do not result in claims.

Ami Maishlish of CompuOffice Software, which sells rate comparison tools to agents, also wants to see insurance sold properly to mortgage clients at bank branches.

“I strongly believe there are too many life insurance contracts out there, where the ‘approval’ is only for payment of premiums,” he says. “The purpose of insurance is dual — coverage should the insured event occur and peace of mind. Post-issue underwriting defeats the second purpose.”

Lance Speck argued that mortgage life insurance is deceptive on two levels: (1) The coverage declines as the mortgage is repaid, but the premiums don’t decline. (2) Banks don’t provide coverage when you sign on, but only if you pass a post-death medical exam.

“Few people will meet this hurdle, as even the slightest illness can disqualify the applicant, even illnesses that have nothing to do with the cause of death,” he said. “This is a clear ethical issue.”

My advice: Talk to independent life agents when insuring your mortgage. Compare rates. Ask whether the insurance company will check your records when you apply or only when you — or your survivors — make a claim.

Ellen Roseman writes about personal finance and consumer issues. You can reach her at eroseman@thestar.ca or www.ellenroseman.com

Mark

Schadenberg, Sales

Representative

Senior

Real Estate Specialist (SRES designation)

Royal

LePage Triland Realty

757

Dundas St, Woodstock

www.wesellwoodstock.com

(519)

537-1553, cell or text

Email:

mschadenberg@rogers.com

Twitter:

markroyallepage

Facebook:

Mark Schadenberg, Royal LePage Triland

Discussion

. . . Direction . . . Determination . . . Destination

No comments:

Post a Comment